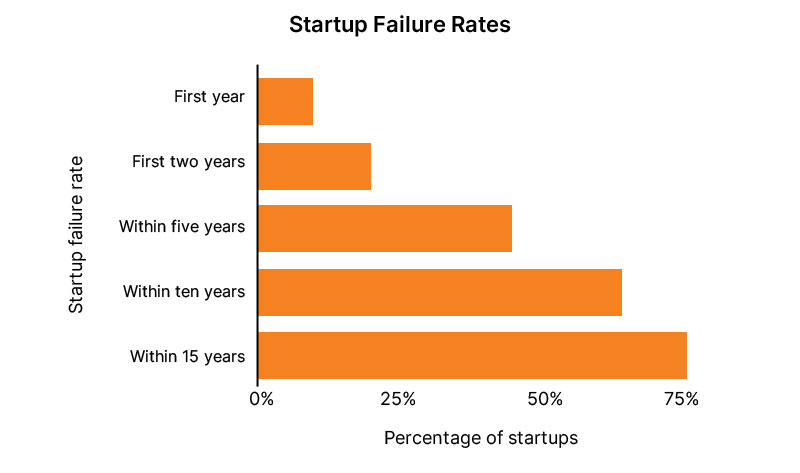

Fundraising for startups is undoubtedly a daunting task. Many entrepreneurs make multiple mistakes while facing investors, which leads to lost opportunities and lowers the spirit. But unfortunately, funded firms also make the same major mistakes over and over. VC funding sources have also seen these mistakes as well. They are watching to see if you are prone to them as well. You must avoid these mistakes to impress VC investors and gain their confidence.

Now that you have raised enough money, it’s time to practice prudent financial management. This is where many startups collapse. You should take control of your startup’s financial health as quickly as possible.

This clearly shows the possible way to position yourself for long-term success would be to face your fund management right now. Proper planning can help you avoid typical financial blunders and convince venture capitalists that you’re committed and will offer what you have promised.

So, in this article, we will delve deep into the most typical financial errors made by startups, along with tips on how to prevent them.

7 Mistakes to Avoid After Getting Funding

1. Not making a budget plan

This is one of the most common mistakes that entrepreneurs make. This typically occurs since startups frequently overvalue the value of the budgeting. You may predict your future earnings and expenditures by using a financial plan and having sufficient cash on hand to pay your expenses.

Here’s how you can create a financial plan:

- Start by identifying which expenditures aren’t needed.

- Describe all of your anticipated monthly earnings.

- Make a list of all the necessary expenses both fixed and variable. These consist of the rent, electricity bills, software maintenance costs, and salary of employees.

- Make a list of all the variable costs. These include non-recurring expenditures and expenditures whose number may vary based on certain circumstances.

Netmartz’s Tip: Be cautious. Forecast your earnings in the lower range and your expenses in the higher range.

2. Failing to manage the cash flow

The term “cash flow” describes the revenue pouring into and flowing out of your startup. Your startup must have a healthy cash flow, meaning more money needs to come in than leave to remain functional. However, profitability isn’t just about possessing a positive cash flow. When sales revenues outweigh expenditures, you have to reach a state of profitability.

For example, a consumer has purchased your software, and you profited from the deal.

Nevertheless, depending on your pricing structure, the consumer can take their time repaying you. So even though you have made a record profit, you haven’t received any money from the sale.

The cash flow gets impacted by this.

Netsmartz’s tips on managing cash flow:

-

- Keep an eye on Accounts receivables and payables: Keep records of the dates on which bills must be paid and when invoices are scheduled.

-

- Spend only when necessary: Pay only when an invoice is due to ensure you always have available cash.

-

- Be cautious of unexpected costs: These are the expenditures that you don’t calculate, like transaction fees, payroll taxes, sudden software upkeep costs, as well as other operating costs. Take note of these costs and keep them under control.

3. Having a jumble of documents

It is essential to balance accounts and maintain a record of all transactions. Patchy recordkeeping may be troublesome for your startup and lead to many problems. Moreover, attempting to correct and sort all this will waste time. To ensure transparency & continued prospects, maintain all the startup documents and verify your financial records with the funds.

4. Recruitment of quantity over quality

It costs a lot of money to hire too several employees. Overspending is a significant financial waste because recruiting staff is the most expensive aspect of operating a startup. As a result, layoffs, later on, will just make the issue worse and harm motivation in the workplace.

A business is also at risk from poor-quality recruitment. This may result in a discrepancy in the workplace culture. As a result, other employees and the startup’s reputation may suffer. So, take your time when hiring. Long-term difficulties can be avoided by taking extra precautions to prevent blunders.

Netmartz’s Tip: Even after getting funding, it is necessary to refrain from overspending. Hiring an in-house team is exceptionally costly. So, outsourcing developers is the best option. By outsourcing, you can not only save huge bucks but also get access to a large talent poll.

Need more info on this? Contact Us!

5. Large business purchases

It’s normal to desire the finest for your startup when it initially gets going: brand-new workstations, a fancy office, and staff that will make the competitors envious. Investing an excessive amount of a startup’s initial cash in pointless expenditures can destroy a startup. Even worse, it could offer you a fanciful impression of stability and success before you’ve put in the effort and made any real progress.

So, limit your spending to what you need to perform your daily activities. Spend hardly anything on unnecessary things. Pay close attention to ego-driven spending like expensive launch parties, team-building retreats, or devices just for show-off.

6. Using personal and professional funds together

It’s more difficult to assess your startup’s performance if your finances are mixed together. As money flows between your personal and business accounts, you may assume that you do not have sufficient funds for improvement and development or that you are performing much better than you think.

Maintain your personal and business finances separate right away. Although it could add to the workload during a year that is already quite hectic, it is essential. Early habit formation is key to long-term maintenance.

Netmartz’s Tip: Create a different personal bank account and credit card, and utilize them exclusively for startup spending.

7. Spending way too little

Although we have already suggested the exact opposite previously, not spending enough can also harm your business. Although you want to keep costs as low as possible, you might not want to sacrifice long-term sustainability.

Certain costs may help your startup succeed more quickly. A few factors which could be beneficial investments for your startup are:

-

- Software management.

-

- Paying adequately to top-notch employees.

-

- Having exceptional customer service.

-

- Developing an engaging and attractive UI.

So, plan for the expenditures that will yield the best returns. You may convert your investments into profits more swiftly the sooner you make it.

Netmartz’s Tip: Membership in professional organizations can also be helpful in this situation. The experts can connect you with firsthand knowledge of which upfront costs may wait till later and which ones are essential in the initial months.

Summing Up

An entrepreneur frequently makes errors that might result in bankruptcy, particularly after receiving initial funding. But with the correct information and knowledge, such errors can be avoided. However, we are aware that all of this is far easier stated than executed.

It’s common for entrepreneurs to stretch themselves too thin and fail to give each activity the proper attention when they have so many things to manage. So outsourcing support for your software might be a good idea.

Netsmartz offers support, maintenance & comprehensive testing, and your software or product audits.

So, get in touch with us today.

Summary

Kickstart Your Project With Us!

Popular Posts

CONTACT US

Let's Build Your Agile Team.

Experience Netsmartz for 40 hours - No Cost, No Obligation.

Connect With Us Today!

Please fill out the form or send us an email to