Quick Summary: The Fintech Industry is constantly evolving with the growing market, consumer needs, and regulatory changes in 2023. What are the latest changes that we are expecting to witness in 2023? Read this blog to find out for yourself.

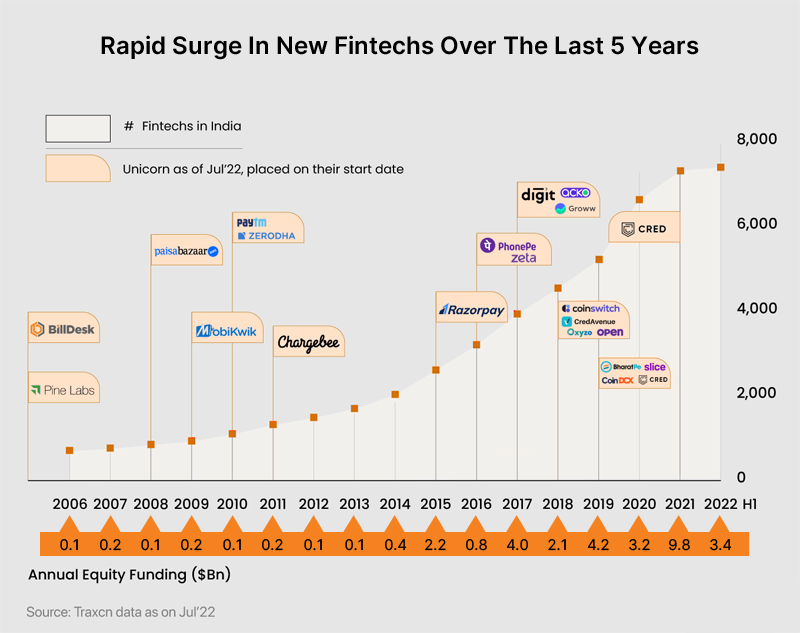

2022 was doubtless a transformative year for the financial industry. From the crypto market crash to the inception of new financial regulations and the rise of “digital-only” banking.

It is no secret that fintech has transformed the processes for banking and financial institutions to meet consumer needs and adopt emerging technologies.

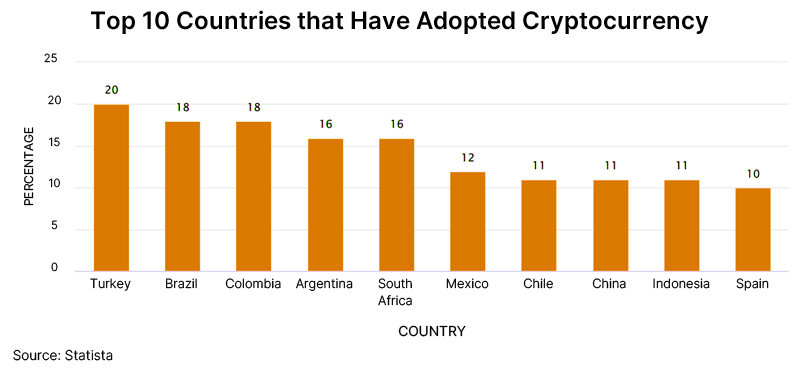

The development of technologies such as Blockchain and Cryptocurrency investment apps is giving birth to new trends. In the below section, we will discuss some of the most prominent fintech trends in the upcoming months:

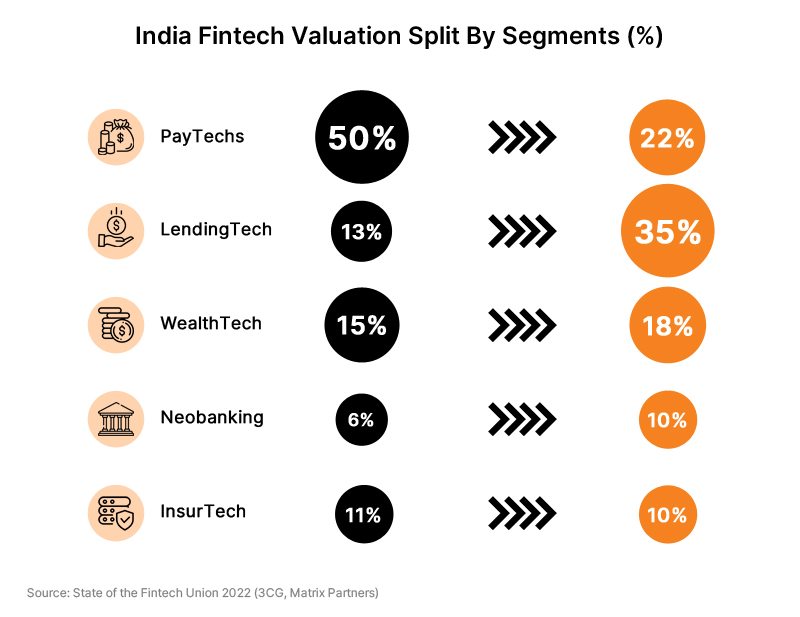

1. Digital-only Banking is on the horizon

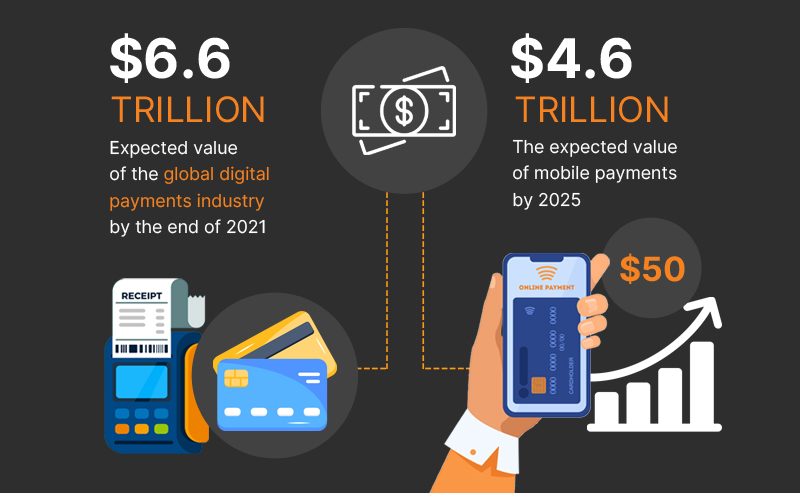

The boom in the digital payment industry was witnessed particularly after COVID-19.

Although COVID-19 brought chaos and uncertainty to economies worldwide, fintech reported average growth in Q1 and Q2 of 2020 (University of Cambridge, 2020).

Since then, digital payments have seen a tremendous transformation and hence the birth of digital-only banks.

Digital-only banks, also known as neobanks, are very similar to traditional banks in operation but have a point of difference in terms of physical footprint. In this type of banking, the consumers can interact with banking representatives exclusively.

Neobanks, such as low startup costs, fast response time for customers, and better user experiences, offer several advantages. The market penetration for such banks is expected to increase over a couple of years.

They’re expanding in numbers and revenue worldwide (Global Market Insights, 2019).

They’re also important reasons visits to bank branches are set to drop by 36% from 2017-2022 (The Financial Brand, 2021).

2. Blockchain- Offering the global finance market a makeover

Blockchain is completely transforming the face of financial transactions globally. Global presence & low processing fees are the two most significant advantages of integrating Blockchain into the financial market.

Here are a few real numbers supporting the same;

- According to PwC, Blockchain can potentially boost the global to $1.76 trillion over the next decade, and China ($440bn) and the US are the most benefitted countries.

- According to IDC, the banking industry is the most significant industry that benefitted from Blockchain, with a share of 29.7 percent, followed by manufacturing and professional services.

- According to another analysis by PwC, there would be a tipping point wherein blockchain technologies would be adopted quickly across economies.

3. AI- The real game changer of the Fintech Industry

Bank revenues are exceeding the national incomes; hence to no surprise, they are the first ones to embrace AI. Banks are fine-tuning the AI solution startegies further to drive the broader adoption of AI in the sector.

AI is projected to reduce the bank’s operational costs by around 22 percent by 2030, up to $1 trillion in savings.

But as easy as it may look, the path to AI transformation could be more complex.

Like the rest of global employers, banks need more professionals skilled in everything AI (8Allocate, 2019).

Due to the features such as chatbots, AI is considered the best customer service software for financial systems. Some of the most popular customer services are Freshdesk, Zendesk, and Live agent.

4. Intensification of Financial Regulations

The financial sector is one of the most heavily regulated industries globally. With the admission of Blockchain, it would earn the attention of governments from all across the world.

According to Data Insider, this could cause nervousness among countries for a spike in headline-grabbing financial breaches.

The outcome could be blockchain investors complaining about regulations not being created. Everyone would agree that security is one of the primary concerns for financial services, no matter what the type.

In this era of digital banking, regulators closely scrutinize the question of data ownership. Each nation will address this question at its own pace. The right outcome here would be a set of national standards that are comprehensive enough to satisfy both businesses and consumers simultaneously.

5. Embedded finance

Embedded finance incorporates financial services and an organization’s operations without diverting customers to conventional financial institutions. Embedded financial systems enable compliance with regulations while offering services such as lending, payment processing, and insurance.

“I think the easiest way to think about embedded finance is how you take non-financial or non-traditional financial products, and you infuse financial services through them.”– Sofiat Abdulrazaaq, CEO and co-founder of Goodfynd.

The potential embedded finance offers are visible as more retailers offer short-term loans through apps such as Klarna and digital wallets.

According to Fintech futures, the market value of embedded finance is expected to exceed more than $7 trillion in the next ten years, combined with the top 30 banks in the world.

The flexibility offered by embedded finance indicates there is a lot of potential for emerging fintech organizations.

6. Digital exchange and trading platforms

Moving money around the world is made easier with digital exchange platforms, and the potential for these platforms to become priorities for financial institutions is high.

Apps that automate transactions between countries efficiently and affordably will be in high demand. Blockchain is also a crucial component in securing those transactions.

While this capability has been reserved for users of digital exchange platforms until now, in 2023, we will see wider adoption of digital exchange technology across traditional finance institutions, increasing the efficiency and security of transacting worldwide.

7. Peer-to-peer finance and credit

With the rise of peer-to-peer (P2P) finance opportunities through multi-service fintech companies, the democratization of lending has been made a reality.

Also, the fintech companies are taking over the control of developing efficient digital platforms that connect lenders and borrowers.

Even non-financial P2P finance and credit help customers manage their risks in a better way.

Millennials, who may have considered borrowing risky in the past, may find P2P finance appealing because it offers credit protection and financial security. Moreover, P2P finance only requires a short application or a guarantor for consumers to receive credit.

Our Collective Future is Fintech

From the preceding, it’s clear that fintech will transform the financial sector in various ways, from boosting the usage of payment gateways to offering credits and assisting people worldwide to conduct commercial and personal transactions amid COVID-19.

Fintech will enhance commerce worldwide because of the much easier account setups and no-fuzz transactions.

China and India’s consistent population growth rates will push fintech into previously uncharted territory.

When combined with rising computing and internet penetration, there is a strong possibility that the present generation will perceive fintech quite differently from what it is now in five years.

Lead the future of Fintech with the best team with Netsmartz.

Contact Us Now

Summary

Kickstart Your Project With Us!

Popular Posts

CONTACT US

Let's Build Your Agile Team.

Experience Netsmartz for 40 hours - No Cost, No Obligation.

Connect With Us Today!

Please fill out the form or send us an email to