Quick Summary: Consumer banking services are disrupting the financial industry. Consumers gravitating towards financial services are making them more accessible, digital, and more. One such upcoming service is Finance software development.

Banks must adapt to compete in the fast-changing fintech landscape of today by combining their older capabilities with newer, digitally enabled features that customers now expect to be necessary.

The fact that a bank has a mobile app does not guarantee that current customers will remain loyal. If the alternative bank can provide better mobile technology and user experience, one in three customers will consider switching their primary bank.

To encourage customers to adopt mobile solutions, banks, and other traditional financial institutions must recognize that well-designed features are essential. Customers’ awareness of user experience has increased as they have become more sophisticated. The mobile experience must stand out because they may already be accustomed to their bank’s web app. In order to provide great customer service, banks look for finance software development.

“Technology is driving a revolution in banking, and banks that invest in developing digital capabilities will be the ones that succeed.” – Jay Reinemann, Managing Partner of Propel Venture Partners.

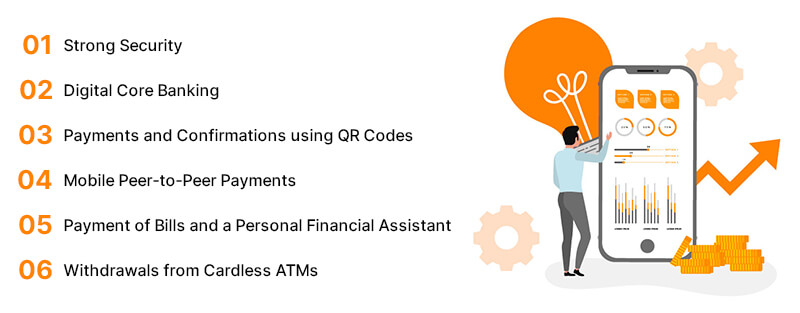

In response to this difficulty, an increasing number of mobile banking apps are beginning to offer the following features:

- Access to investment products, whether offered by the bank, a marketplace, or third-party institutions,

- Interoperability with external apps and services, particularly payment gateways, eCommerce platforms, digital wallets, and many other types of financial and digital services,

- Keeping up with these trends may require complex changes that go beyond technology interventions,

- User access and authorization in a way that is both easy and secure,

- Personalization that responds to the user’s behavior and personal financial goals,

- Dashboards and displays that can show transactions, spending, and insights at a glance,

- Work in a variety of areas, including talent, regulation, internal business processes, and commercial partnerships, are all part of these.

Nonetheless, clients expect some elements as unquestionable requirements for their portable banking applications today. Banks can establish a solid foundation for later exploration of additional app features by starting with these specific capabilities.

1. Strong Security

Regarding their online habits and the digital products and services they choose, customers recognize cybersecurity as one of the most critical factors. From the perspective of bank customers, app security is simply preventing malicious actors from stealing their money.

Banks have the most influence over threats to the server layer and the transit layer (the communication between the server and the mobile device) of mobile apps.

In a survey of IT professionals, 75% of respondents said that mobile devices pose a significant security threat to their organization. (IDG)

Because attacks on mobile banking apps take advantage of user behavior, this places the user and device layer in the most vulnerable position.

Some of the most prevalent varieties of these threats are as follows:

- Phishing Apps or Fake Banking Apps: Over $48 million has been stolen from the top 1,000 highest-earning apps, according to one study. Most of the time, these bogus apps are copies of legitimate banking apps made to look like the official mobile platform.

- Malware and Trojans: Malicious code that steals customer data when they use their banking apps is the source of this threat. One-time passwords (OTPs) can be stolen from SMS by these attacks.

- Attack by a Man in the Middle: In this attack, the malicious actor either eavesdrops on or pretends to be one of the parties to intercept a conversation or data transfer between two people to give the impression that the flow of information is normal. To hijack users’ data or login credentials for any app, the attacker might, for instance, set up a “free” wifi connection.

This does not imply that users are primarily to blame when these attacks occur. In point of fact, banks bear the responsibility of minimizing these threats through user-friendly design and security features.

This is accomplished by utilizing a combination of security features like:

- Encryption from beginning to end,

- Password dictionaries,

- Multi-factor or third-party authentication,

- Multi-factor or third-party authentication,

- AI-powered behavior analysis,

- Continuous authentication,

- Real-time alerts via SMS, email, or push notification Customer education and reminders.

The trade-offs between security and user experience (UX) are always the subject of heated debate. Security and user experience design can work together in banks and other financial institutions.

There are industry standards and best practices that can appropriately address security risks while providing customers with an outstanding user experience, even though there is no mobile app that is 100% secure—and there has never been.

2. Digital Core Banking

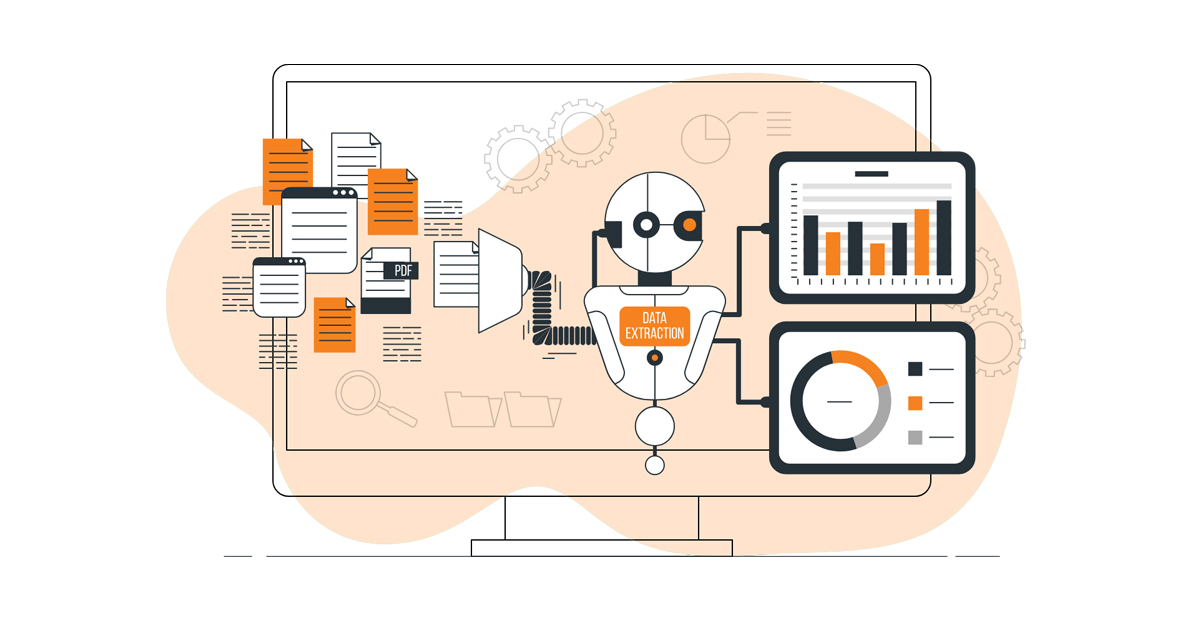

Bankers already know that digital core banking is the back-end system that updates accounts and other financial records and processes all banking transactions. Customer onboarding, deposit management, account-to-account fund transfers, loan processing, cash management, ledger systems, reporting tools, analytics, and security management are all examples of traditional core banking systems.

Core banking providers have developed a new generation of digital core banking tools that place an emphasis on the customer experience in digital channels in order to meet today’s customer expectations.

Digital core banking systems, for instance, enable banks to directly onboard new customers via web and mobile apps rather than requiring them to fill out seemingly endless and redundant paperwork.

The know-your-customer (KYC) process and verifications are also made easier with digital onboarding. Digital identity management and authentication procedures ease online transactions and safeguard user data and privacy.

The digitization and integration that helped bank employees become more efficient and have better visibility over their data were the primary focuses of traditional core banking systems. The customer’s experience with the bank’s web and mobile channels is streamlined and secure thanks to the more recent digital core banking tools.

Solarisbank, a German financial technology company, offers its Banking-as-a-Service platform to businesses—not just banks—that want to offer digital banking, cards, consumer lending, and payments as part of their banking services. Solarisbank focuses on core banking technology and regulation so that their client institutions can tailor the end-user experience to their customers’ satisfaction.

Digital transformation is typically viewed as high-risk by established banks. According to one report, the global banking industry would need approximately 25 years to replace all existing legacy systems. A lot of digital core banking solutions make it possible to integrate digital core banking systems with legacy core banking systems in a so-called “multi-core” approach. Banks can build modern platforms that interact with customers, which can lower the risk of replacing outdated systems.

3. Payments and Confirmations using QR Codes

Banks should also think about including QR (Quick Response) code payments in their mobile apps. The appearance of QR codes is likely familiar to the majority of customers: a two-dimensional pattern of white-and-black squares arranged in a square grid. QR codes, as opposed to barcodes, can be scanned not only from paper but also from screens. They also store more data. Because it can be encrypted, it is also safer than barcodes.

Although it initially gained traction in Asia, the use of QR codes has expanded to numerous markets. 1.5 billion people will use QR codes to pay in 2020, and their use is expected to skyrocket during the COVID-19 pandemic. By 2025, according to one study, up to 30% of smartphone users worldwide will use QR codes to pay for $3 trillion in transactions.

While QR codes are already available as a payment method in digital wallets and other fintech apps, banks should also make it possible for customers to pay with QR codes within their mobile apps. QR code payments reduce the amount of friction involved in the payment or fund transfer process in comparison to account-to-account transfers and even credit card payments.

Because of this, QR code payments are the preferred method for quick and small payments. Payments for street vendors, restaurants, small businesses, toll booths, parking, fueling stations, donations to charities, and entry into events are just a few examples of use cases.

In addition to accepting payments, banking apps’ QR codes can also be used as a receipt or confirmation. A confirmation with a QR code, for instance, can be generated by some mobile banking apps and used as a ticket when entering a venue. Banking apps can be more than just payment apps with the help of QR code features.

4. Mobile Peer-to-Peer Payments

Peer-to-peer (P2P) payments are a method of transferring money from one person’s account to another’s account through a mobile app that is more user-friendly and streamlined than web app account-to-account fund transfers. One method for this is QR code payments.

Some fintech and bank apps allow P2P payments by sending money to the recipient’s mobile number, email address, or username, in addition to QR codes and bank account numbers. Users might not even need to know the bank of the recipient. The system will handle the transfer if you simply send money to a friend’s username or mobile number.

The user experience (UX) for P2P mobile transfers can sometimes be overlooked in the belief that it doesn’t really need to differ from the web app experience because account-to-account transfers have been an established capability for banks. As we now know, this was one of the most important areas in which fintech companies innovated.

By the end of 2020, 70% of adults in the US will have used at least one peer-to-peer service, up from 57% in 2017. Non-bank fintech players such as PayPal, Venmo, Zelle, and Cash App, among others, are driving the ongoing adoption of P2P services. In other markets where digital wallet providers are leading the charge in peer-to-peer payments, this trend appears to be similar.

Although the most common use case for peer-to-peer (P2P) payments is currently instantaneous, small, and casual payments, businesses are expected to benefit from P2P networks as they develop. P2P channels are slowly being used by small and medium-sized businesses (SMEs) to pay individuals (like payroll) and other businesses (like loans and payments to vendors).

One advantage is that it can assist businesses in settling their debts or payables more quickly than check payments because of the time it takes for checks to clear and be verified.

5. Payment of Bills and a Personal Financial Assistant

Paying bills and setting aside money for savings and investments can be unpleasant because they represent the regular financial commitments people must make. Apps for mobile banking can and should make this more bearable.

For instance, recurring bills like electricity, water, broadband, insurance, loans, and others should be able to be paid automatically through banking apps. to assist customers in making timely payments and to lessen the mental strain of thinking about these obligations.

Scan-and-pay features, particularly for QR codes, should also make it simple to accept one-time payments. This is useful for things like paying property taxes, paying fines, and making payments over the counter.

Additionally, these apps are becoming a personal financial assistant thanks to recent advancements in mobile banking. Customers should be able to do more than just check their account balance and transaction history regarding the informational value that bank apps should provide.

Users of some banking apps can now track their spending, manage their monthly budgets, and generate insights to help them make better financial decisions. Today’s banking apps help customers save for their next dream vacation and make payments.

An automated or innovative savings feature is one relatively recent digital banking feature. Customers can direct some of their direct deposits into a variety of savings goals or accounts with this option for savings accounts.

If the bank system determines that the customer does not require a portion of the savings for anything urgent, it will analyze the accounts and move the money to designated accounts or categories. This is another variation of automated savings.

6. Withdrawals from Cardless ATMs

Customers of a bank can withdraw money from an ATM without using a physical card thanks to the Cardless ATM feature. The mobile app of the bank is where authorization and verification are carried out.

The ATM will show a QR code that the customer needs to scan with their smartphone when they withdraw money. Alternately, some cardless ATM withdrawals use near-field communication (NFC) technology, which requires the user to tap their phone against the reader of the ATM.

Customers would no longer need to carry their debit cards if this feature were available in mobile banking apps. This is an obvious benefit. In addition, cardless ATM withdrawals are safer than traditional card-based withdrawals.

First, card skimmers are no longer a threat. Additionally, two-step authentication is typically required for cardless withdrawals. A thief who has access to your device, for instance, needs to know your smartphone PIN, your bank app account credentials, and your specific PIN for authorizing card ATM withdrawals.

Although this is still not widely used, the number of ATMs that allow for cardless withdrawals increased by 26% in 2019. Cardless ATM withdrawals are expected to grow as a result of the COVID-19 pandemic because consumers want to avoid or reduce their physical contact with public devices like ATMs.

What’s more in Mobile App Banking?

In order to remain competitive in the constantly changing fintech industry, banks must adapt by integrating new, digitally advanced features that are now considered essential by customers while also leveraging their established capabilities.

Just having a mobile app is no longer enough to retain existing customers, as a significant proportion indicate they would consider switching to another bank if they could offer better online and mobile technology. Find banks that invest in mobile app development solutions to enhance customer satisfaction and ease.

Therefore, banks must recognize that having well-designed and user-friendly features is crucial in gaining customer adoption of their mobile solutions. With customers becoming increasingly sophisticated and demanding better user experiences, banks must ensure their mobile experience stands out even if the customer is already familiar with their web app.

To further meet the challenges in banking industry, mobile banking apps are offering the following capabilities:

- Effortless & secure user authorization

- Personalization for user’s behavior and personal goals.

- Dashboards depicting transactions, spending, and insights.

- Availability of the correct information on every transaction.

- Better access to investment products, marketplace, and third-party institutions.

Design & develop powerful mobile experiences across platforms with us.

Request Free Consultation

Summary

Kickstart Your Project With Us!

Popular Posts

CONTACT US

Let's Build Your Agile Team.

Experience Netsmartz for 40 hours - No Cost, No Obligation.

Connect With Us Today!

Please fill out the form or send us an email to